How To Compete Against Cash Buyers in Silicon Valley

May 21, 2025

This original analysis article, authored by John, originally appeared in Palo Alto Online on April 4, 2025.

You are a dual-career couple living in the Midpeninsula, and it’s time to upgrade. But without inherited wealth, how do you compete against cash buyers?

Sellers typically prefer cash buyers because less can go wrong, and the time to close escrow is dramatically shorter – all-cash deals typically close in seven to 10 days vs. 21-30 days for financed deals.

Cash buyers may have a definite advantage, but those needing financing can – and do – win bidding wars every day.

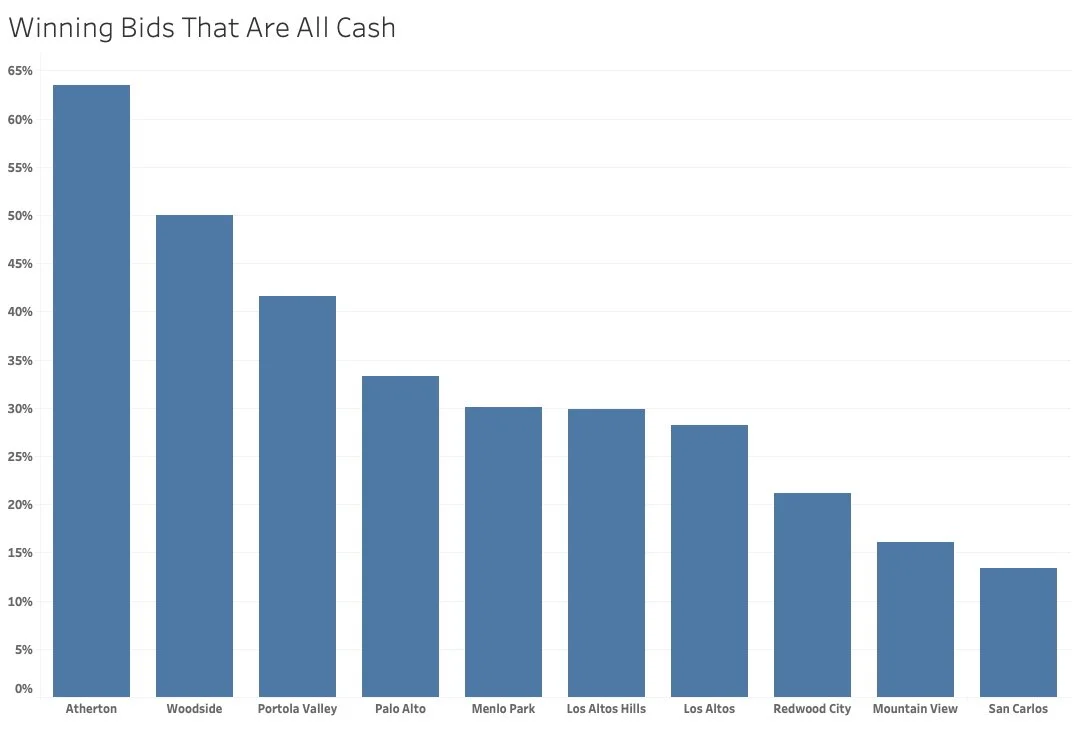

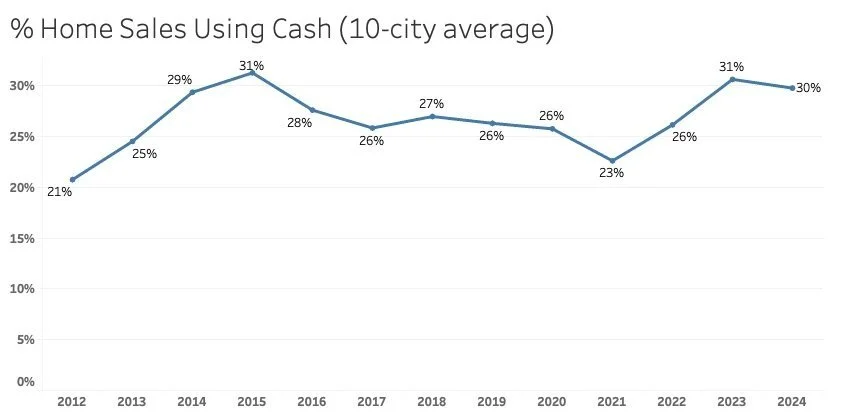

We examined 31,105 transactions across 10 Peninsula cities over the past 12 years – from 2012 to 2024 – to determine what markets see the most cash deals, how often they occur and whether cash deals are becoming more common. Here’s what we found.

How common are cash buyers?

The prevalence of cash over financed deals really depends on where you are looking to buy. In Atherton, over the past 12 years, data shows that 65% of transactions were completed with cash, whereas up-and-coming San Carlos showed only 13% of transactions completed with cash:

Woodside and Atherton were the only cities where cash was used in 50% or more of sales transactions. In Portola Valley, Palo Alto, Menlo Park, Los Altos and Los Altos Hills, more than a quarter of all transactions were cash.

In comparison, less than a quarter of transactions in Redwood City, Mountain View and San Carlos were cash deals.

This chart undercounts Atherton, because our data excludes off-market transactions. These are immaterial for most cities, because there are relatively few off-markets, and their ratio of cash:financed is similar to the “on-MLS” data. However, this is not the case in Atherton, where our area’s most expensive, prestigious, and private properties lie. The complete picture of Atherton is probably around 70% in cash.

By the way, “cash buyers” do not literally walk into the closing with suitcases of money like a gangster. They just wire money, or get a cashier’s check, without a lender being involved.

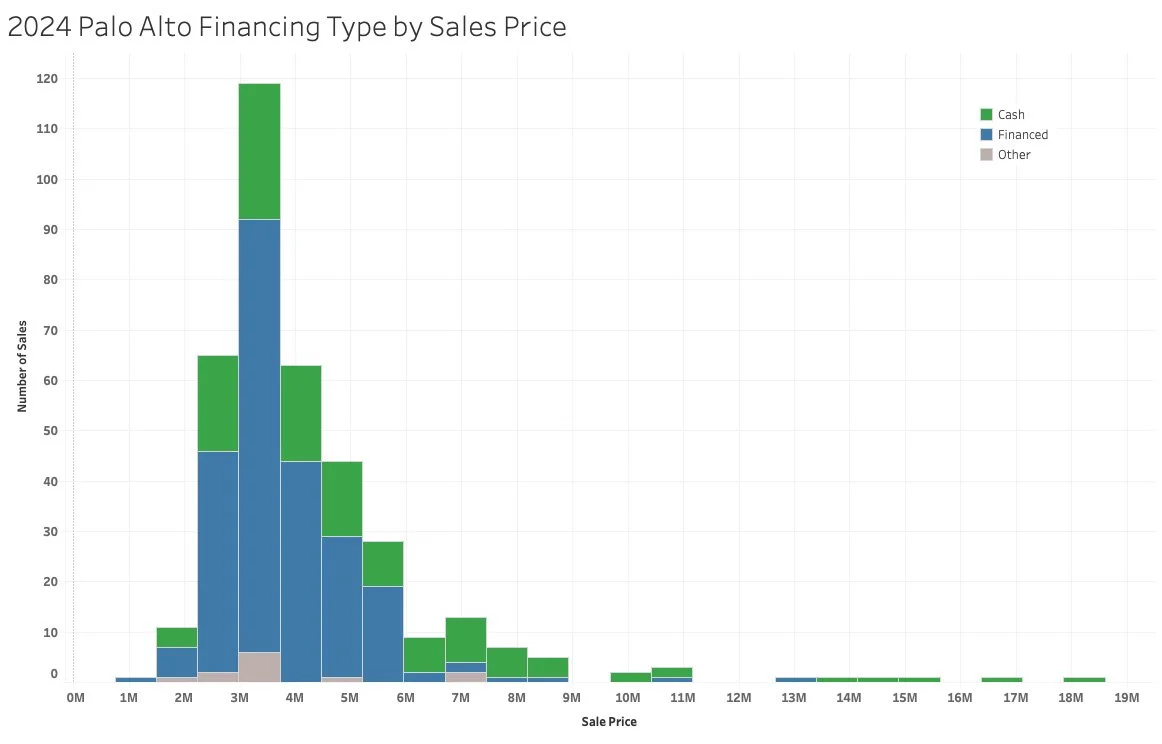

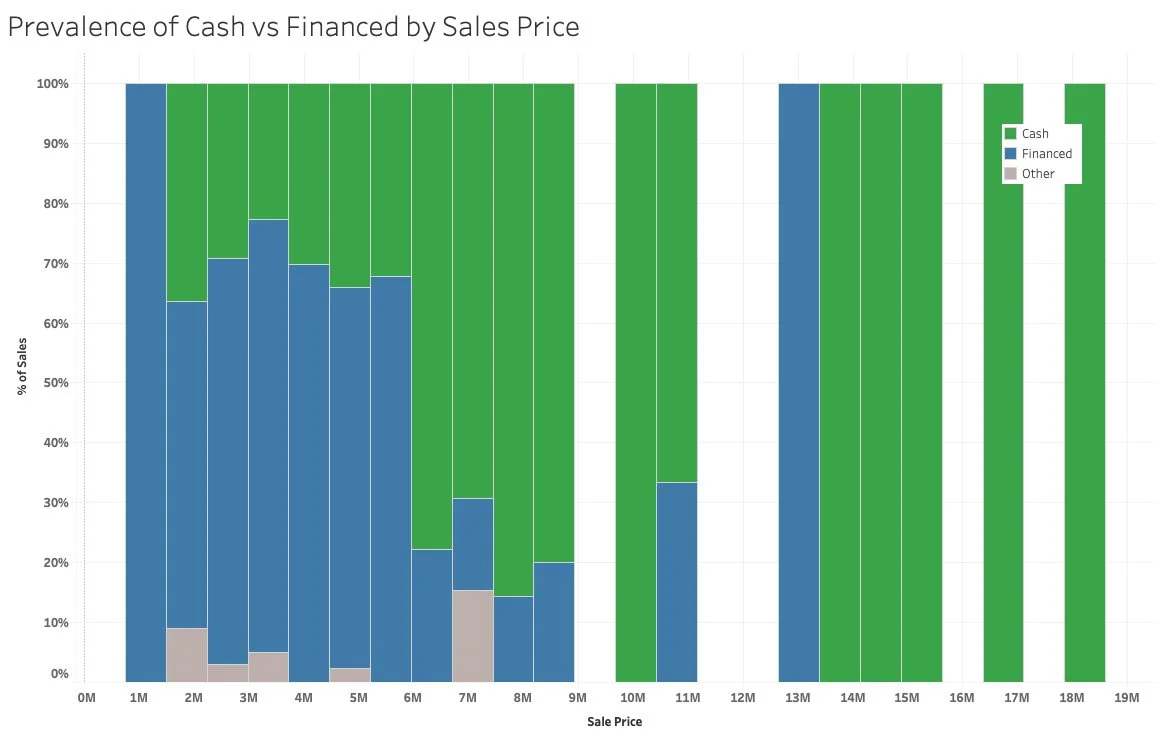

How do cash deals vary by price point?

As you might expect, cash is more prevalent at the higher price points. In 2024, roughly two-thirds of all sales for homes priced between $2 million to $6 million were financed. That number drops as sales prices rise. Only about a quarter of all transactions for homes priced above $6 million to $11 million were financed. For price points above that, cash is dominant:

There are fewer transaction at the high end, but those tend to be dominated by all cash:

The chart above shows that, in 2024, roughly two thirds of all sales between $2-6 million were financed, but then drops to about a quarter of all transactions between $6-11 million, and above that cash is dominant.

Are all-cash deals getting more common?

There is a general feeling that the rich are getting richer, but the data is ambiguous about this:

Across all 10 cities, 2015 and 2023 were the peaks, with 31% of transactions in the region using cash. This number has been as low as 21% (in 2012) and 23% (in 2021).

How important is cash to sellers?

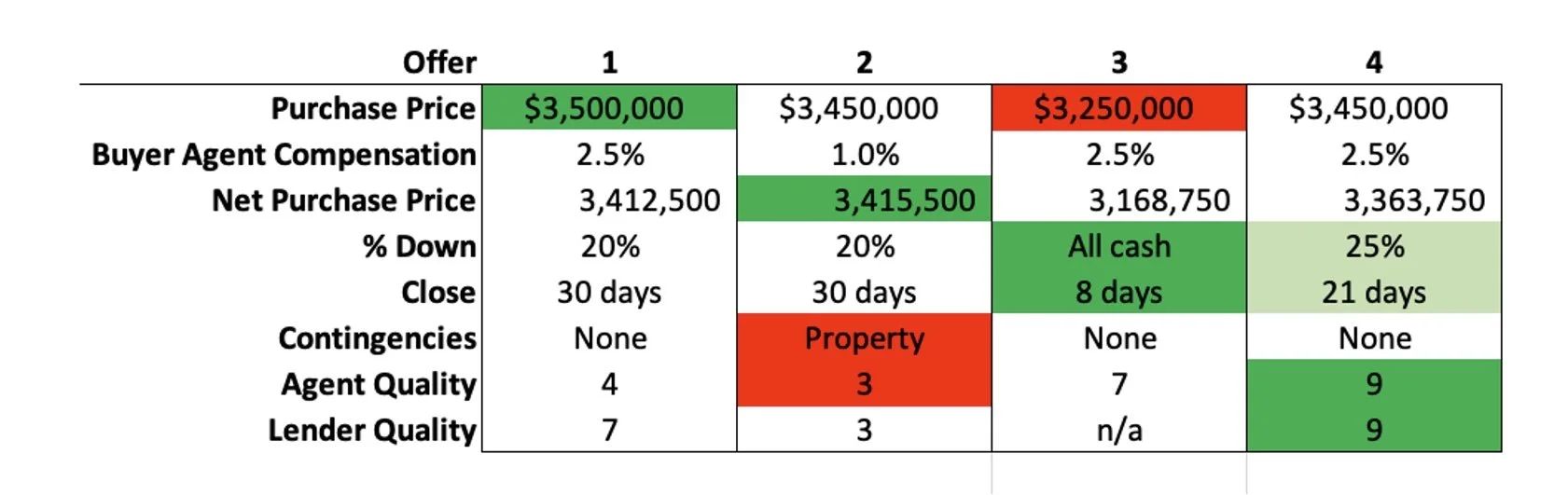

All things being equal, almost every seller will choose the cash offer – but things are rarely equal. Here is a hypothetical summary of four offers, as we might summarize them to our seller clients:

For many sellers, the price is the most important deal term, but the net price (after buyer agent commissions, which are often paid by the seller) matters more. In the chart above, Offer #1 has the highest purchase price, but because Offer #2 comes from a discount agent who takes less commission, the net purchase price to the seller is higher. For a seller who values absolute return, Offer #2 is the best.

But will the seller choose Offer #2? Not necessarily. Offer #2 also includes a property contingency – this protects the buyer but leaves the seller exposed if the buyer backs out. Contingencies are a significant liability in a multiple-offer situation. Offer #2 now looks weaker.

Offer #3 is all cash, and can thus close in eight days, as opposed to 21 or 30 days. For a seller who values speed and safety, Offer #3 looks strong.

By contrast, Offer #4 has an experienced lender and a well-known, respected agent who has closed multiple deals with the listing agent — all with no hiccups. From the seller’s point of view, weak agents might not have reviewed the disclosures in detail, or educated their clients about the flaws of the property or glossed over contractual provisions. These offers have a higher chance of falling apart in escrow. For these reasons, Offer #4 looks strong.

Offer 4 also looks slightly stronger than Offers #1 or #2 because it can close in 21 vs. 30 days, and the buyer is putting 25% down as compared to the minimum 20%.

In a close competition, these little things matter.

As you can see, paying all-cash is just one of the deal terms that will help you win. Crafting the right offer — gaining the intel about what the seller values and factoring in your priorities and concerns — can lift you over the competition, even if you cannot afford the luxury of buying with cash.

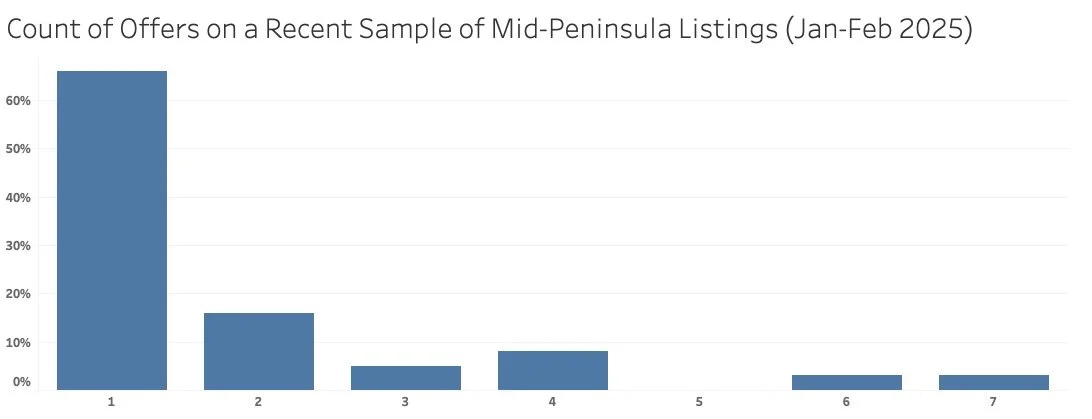

How competitive is it in today’s market?

One way to win with a financed offer is to be the only offer, but how common is this? More than you might think. In the first two months of 2025, our data shows that roughly two-thirds of all Midpeninsula listings received just one offer.

If the other terms are acceptable, your one financed offer is likely to be accepted.

(Note: This data related to single offers collected at the start of 2025 is very market- and time-dependent. Three years ago in the Midpeninsula, it would have been common to have 10-plus offers on a property.)

Sometimes the “one offer” is pre-emptive: on the market but before the listing agent calls for offers. Sometimes it is off-market (not listed publicly on the Multiple Listing Service): a listing that is being prepped, for “members only,” or learned about by good communication between productive Realtors. Sometimes it is a property that is priced so high, the competition has been scared off. Again, a good agent can help you navigate all these scenarios.

You *Can* Win against All-Cash Offers!

Two thirds of houses bought in the mid-peninsula win out over their competition despite not being all-cash. Whether it be via price, other deal terms, or by being the only offer, it is possible to win against All-Cash offers.

About the Authors/Datamancers

The Young Platinum Group (aka Gloria and John) specializes in Palo Alto, Atherton, and surrounding areas. We work with buyers, sellers, and builders to enhance exceptional lives in the finest homes in the heart of Silicon Valley.

Would you like this sort of data on your side in your next real estate transaction? Or a complimentary analysis of what your home is worth in the current and ever-evolving market? Contact us to start.

This sort of original analytical work, customized on your behalf, with our fabled customer service, can be deployed for your needs to make your next move a smooth and happy one.

We proudly affiliate with Golden Gate Sotheby’s International Realty for our realty activities, and the Peninsula’s finest builders, architects, and designers for our development projects.